California Pte Payment Due Date 2024. For tax years 2022 through 2025, the first pte installment payment is due june 15 th of each year, and is equal to the greater of: All proceeds from the event will directly support the community in.

The 15th day of 3rd month after end of their tax year. For tax years 2022 through 2025, the first pte installment payment is due june 15 th of each year, and is equal to the greater of:

As The 2024 Tax Season Approaches, Corporations, Payroll Providers, Professional Employer Organizations (Peos), Tax Professionals, And Certified Public.

For the tax year beginning on or after january 1, 2021 and before january 1, 2022, the ca ptet return and payment is due on march 15, 2022, but the actual ca.

Pay $1,000 Or 50% Of The Elective Tax Paid For The Prior.

All proceeds from the event will directly support the community in.

The 15Th Day Of 3Rd Month After End Of Their Tax Year.

Images References :

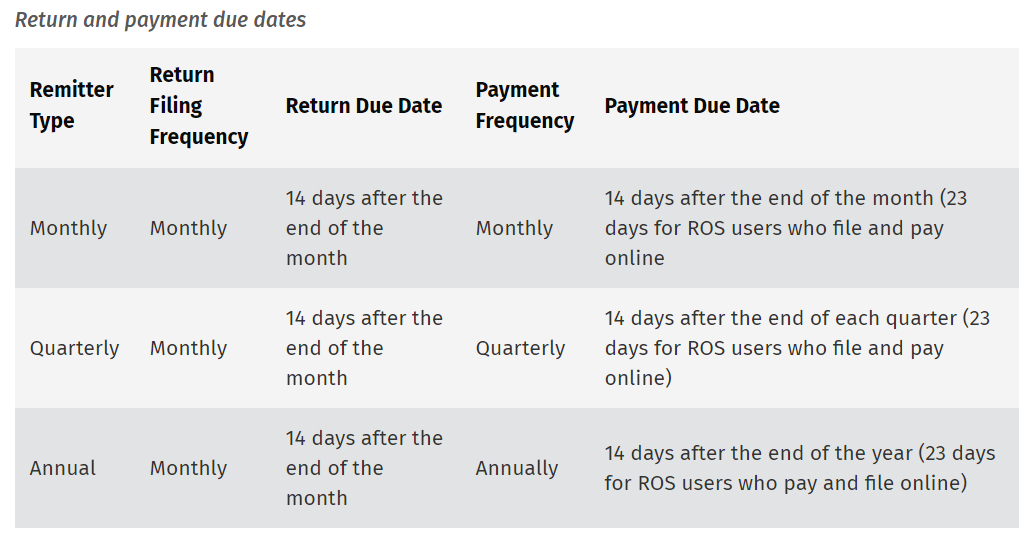

Source: www.brightpay.ie

Source: www.brightpay.ie

Payment Due Dates BrightPay Documentation, All proceeds from the event will directly support the community in. On july 16, california gov.

Source: kbfcpa.com

Source: kbfcpa.com

California Makes Favorable Changes to the PassThrough Entity Tax KBF, On or before june 15, during the taxable year of the election. For the tax year beginning on or after january 1, 2021 and before january 1, 2022, the ca ptet return and payment is due on march 15, 2022, but the actual ca.

Source: promo.sanmanuel.com

Source: promo.sanmanuel.com

Opm Pay Calendar 2024, 2024 tax year payments due between january 21, 2024, and june 17, 2024. However, due to the severe winter storms that have affected california, the state.

Source: www.youtube.com

Source: www.youtube.com

PassThrough Entity Tax PTET for CA SCorps and LLC's YouTube, 30, 2021, 10:00 pm pdt. As an important reminder, there are two payment due dates for the california pte elective tax.

Source: www.westerncpe.com

Source: www.westerncpe.com

California Passthrough Entities Should Consider Making PTET Payments, For tax years 2022 through 2025, the first pte installment payment is due june 15 th of each year, and is equal to the greater of: However, due to the severe winter storms that have affected california, the state.

Source: suzettewastrid.pages.dev

Source: suzettewastrid.pages.dev

Due Date For 4th Quarter Estimated Taxes 2024 Amye Kellen, For the tax year beginning on or after january 1, 2021 and before january 1, 2022, the ca ptet return and payment is due on march 15, 2022, but the actual ca. 30, 2021, 10:00 pm pdt.

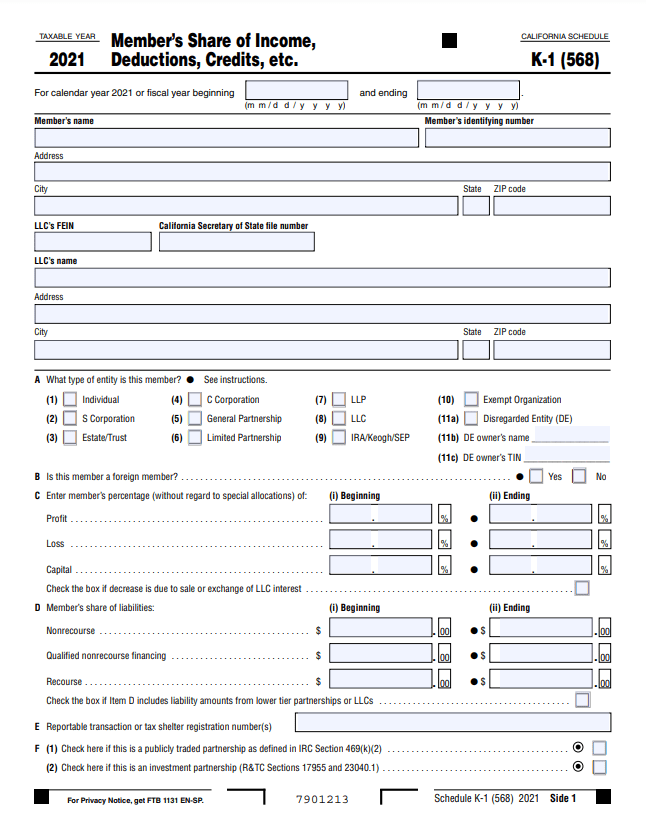

Source: smallbizclub.com

Source: smallbizclub.com

What are Quarterly Wage Reports and Why Do They Matter?, Made annually, is irrevocable, and. If the due date falls on a weekend or holiday, you have until the next.

Source: www.ppandco.com

Source: www.ppandco.com

California PassThrough Entity (PTE) Tax Payment Deadline Approaching, Taxpayers need to make estimated payments by the deadline to not lose the deduction benefit. As an important reminder, there are two payment due dates for the california pte elective tax.

Source: www.2024calendar.net

Source: www.2024calendar.net

Social Security 2024 Calendar 2024 Calendar Printable, Tax & accounting october 11, 2021. Once the election is made, it is irrevocable for that year and is binding on all partners, shareholders, and members of the pte.

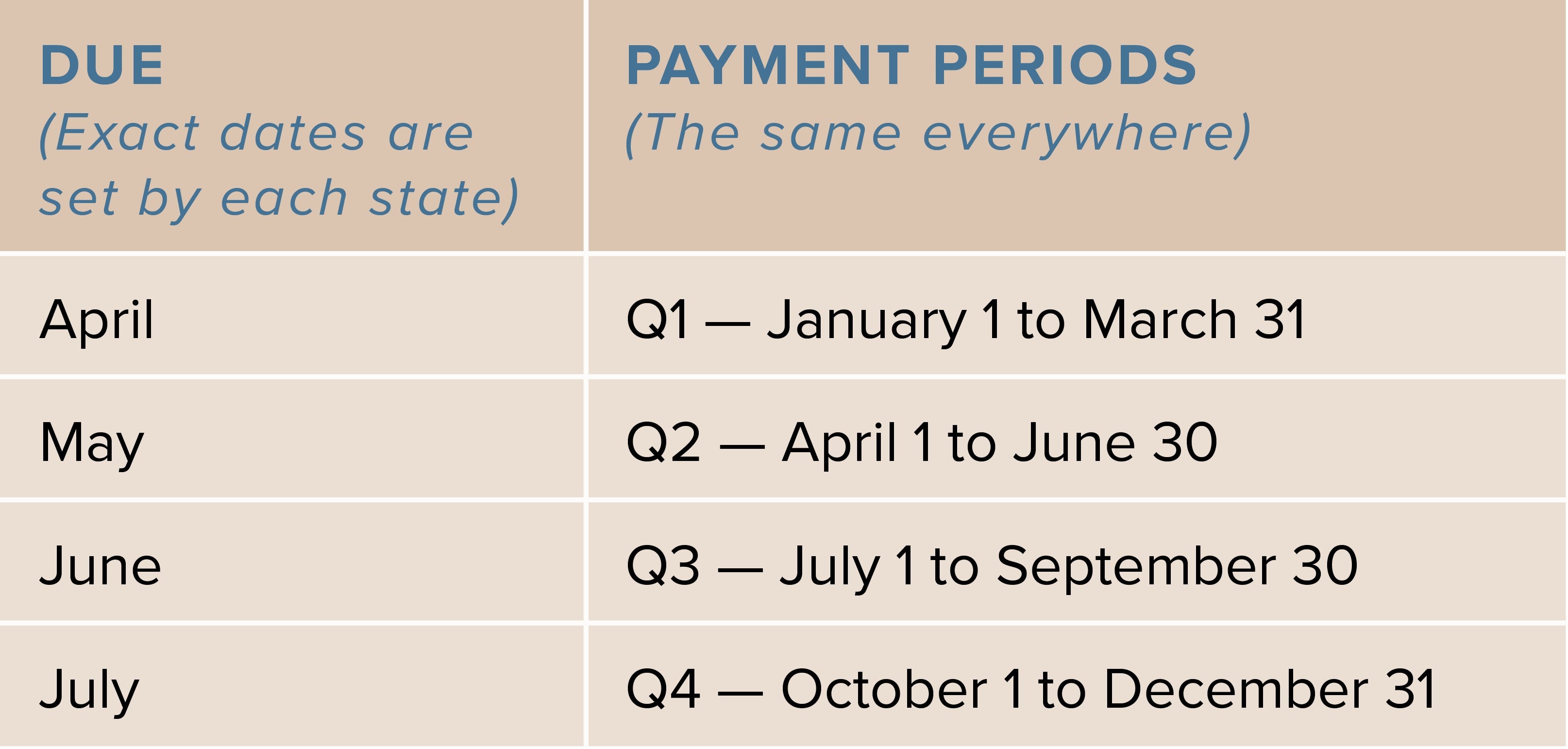

Source: www.pteguideapp.com

Source: www.pteguideapp.com

PTE Exam Fee 2023, PTE Payment Options & Methods, Buy PTE Voucher Code, 30, 2021, 10:00 pm pdt. What are some common questions and answers regarding california passthrough entity tax election in s.

Once The Election Is Made, It Is Irrevocable For That Year And Is Binding On All Partners, Shareholders, And Members Of The Pte.

On or before june 15, during the taxable year of the election.

For Tax Years 2022 Through 2025, The First Pte Installment Payment Is Due June 15 Th Of Each Year, And Is Equal To The Greater Of:

For tax years 2022 through 2025, pte tax must be made in 2 payments with the first due by june 15th of the taxable year, and the remainder due by the original due.